GESSLER CAPITAL

CREATING GROWTH

One partner, multiple solutions.

FINANCIAL PRODUCTS

As your sparring partner we can offer you access to a wide range of securitization and fund solutions.

We aim to serve our clients as a neutral platform for a variety of financial product solutions across different jurisdictions. These products are partly of the second generation and completely off a (bank) balance sheet eliminating the so called issuer risk. Through us, our clients (banks, asset managers, family offices and PE/PD/VC companies) get access to very flexible and widely accepted financial wrappers such as MTNs, trackers, AMCs, fund or even STO solutions.

OTHER SERVICES

Our extensive network is our asset. We can connect you to the right persons and open doors of opportunities for you.

We are continuously expanding our network across the different wealth creation disciplines. Our clients gain access to our large and valuable network. Our aim is to listen to the client's needs and to provide the right contacts to talk to. There will be no extra surcharges!

VISION

We aim to be a reliable and innovative partner, acting as a securitization and fund solutions platform for an extensive international client base. We write success stories by continuously expanding our service offerings through long-term cooperations and competitive conditions.

MOST FREQUENT CLIENTS

WHITE PAPERS

Contact our experts to obtain one of these white papers.

MEET OUR EXPERTS

VINCENT GESSLER

FOUNDER & CEO

OLIVIER SUTER

PARTNER & SOLUTION EXPERT

RENÉ PRINCE

PARTNER & SOLUTION EXPERT

SERGIO SOLER

PARTNER & SOLUTION EXPERT

ANIMATED EXPLAINERS

FAQs AND FACTS

CLIENT JOURNEY & COVERAGE

SOLUTIONS

Guernsey SECURITIZATION

Ideal for smaller projects with an equivalent of USD 1 million or more. These products are classified as structured products.

+ Low set-up costs and no annual minimum fees

+ Flexible in design and off-balance sheet

+ No audit requirement and therefore cost-saving

- Guernsey has hardly any double taxation agreements (may reduce the return to investors)

- Income from an off-shore jurisdiction may be subject to higher taxation to some investors

We offer protected cell solutions in Guernsey upon request.

Luxembourg SECURITIZATION

Ideal for larger projects with starting capital of USD 6 million or more. These products meet the highest industry standards and are usually classified as bonds.

+ Flexible in design and off-balance sheet

+ Luxembourg has many double taxation agreements and is highly recognized by the market

+ For many investors, income from an onshore jurisdiction is taxed lower

- Higher set-up costs and annual minimum running fees

- Audit requirement by law and thus additional costs (but also additional certainty to investors)

We also have access to lower cost platform solutions for AMCs with predefined brokers and can offer issuance programs where you can benefit from reductions.

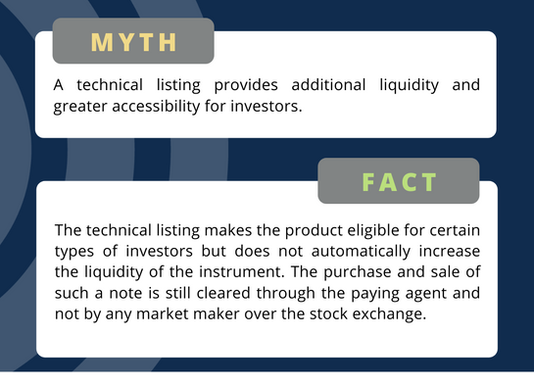

Uncovering wrong assumptions

Swiss FUND SOLUTION

Switzerland is one of the top financial centers and traditional safe havens around the globe. Swiss wealth management has a very long tradition that can be attributed to its economic and regulatory stability and high quality standards. Asset managers investing into bankable assets with a domestic client focus might prefer such a Swiss format with retail access to a more expensive European fund solution.

+ Access to Swiss Retail and Professional Investors.

+ Switzerland is a AAA-rated economy.

+ Time-to-market and lower costs compared to Luxembourg.

- No EU passporting by standard

Liechtenstein FUND SOLUTION

Liechtenstein is an active member of the European Economic Area (EEA) and therefore has unrestricted access to the European domestic market and Switzerland. The Principality of Liechtenstein has been a traditional and proven financial center for many decades, with a high degree of legal security and political stability. The liberal economic system, as well as transparent and internationally corresponding tax and legal standards are the success factors of this location.

+ EU passporting and access to Switzerland.

+ Liechtenstein is a AAA-rated economy.

+ A quicker time-to-market and lower costs compared to Luxembourg.

- Offers highest quality standards, but is less popular with investors.

The Liechtenstein Private Label Fund (PLF) is often seen as an alternative to its Luxembourg counterpart, especially by German-speaking clientele. The PLF is a very flexible AIFMD-compliant fund and benefits from passporting advantages for distribution to professional investors across the EU as specified under MIFID. Ideal for projects with starting capital of

USD 50 million in AUM. This format is suitable for actively managed portfolios or single replications.

Maltese FUND SOLUTION

Malta is a small yet stable European Union country in the Mediterranean with a Standard & Poor’s ‘A-‘ rating. The financial services industry in Malta meets all European standards and is supervised by the Malta Financial Services Authority (“MFSA”). The country has undersigned over 70 international double-taxation agreements.

The Maltese Professional Investor Fund (PIF) is among the few EU-regulated collective investment vehicles that allow for investment in Virtual Financial Assets and therefore enable you to run a Crypto Fund due to their low investment restrictions.

This format, similar to that of a hedge fund, will not benefit from passporting rights within the EU/EEA according to the Alternative Investment Fund Managers (AIFM) Directives.

The PIF is subject to private placement and only qualified investors are eligible, as specified by the Malta Financial Services Authority (MFSA).

A PIF exceeding EUR 100 million must become a full-fledged AIF and appoint a depositary and an AIFM.

Luxembourg FUND SOLUTIONS

Luxembourg is considered as a prime location for alternative investment funds and is indisputably the largest Investment Fund center in Europe and the second largest in the world after the US.

+ International orientation, excellence and stability

+ Luxembourg is a AAA-rated economy.

+ Luxembourg funds offer investors the highest quality standards (state of the art)

The Luxembourg Reserved Alternative Investment Fund (RAIF) is a very flexible AIFMD-compliant fund and benefits from passporting advantages for distribution to professional investors across Europe as specified under MIFID. This format is suitable for larger actively managed portfolios starting from EUR 30 Mio on Bankables in AUM and EUR 50-60 Mio in AUM on Non-Bankables.

Licensed clients or funds with a very large starting amount could also benefit from all-in pricing, depending on the case. Talk to our experts to learn more.

Tokenizing Securities

Security Token Offerings (STOs) revolutionize the way you issue company shares, debt, or financial instruments. While local laws still apply to issuing companies, STOs offer an innovative format that benefits all involved stakeholders and extends your reach to a new generation of investors by enabling fractional ownership shares held in their crypto wallets.

Thanks to blockchain technology, share registers and shareholder communication can be handled in a fully digitalized way. Smart contracts grant ownership to authorized investors only and ensure flawless secondary settlement between buyers and sellers.

By tokenizing a security, you reduce settlement risks as well as the complexity and bureaucracy of managing your securities.

IN THE PRESS

"Gessler Capital expands financial offerings to include Luxembourg securitization solutions"

- Press Release (27.11.2019)

"One-stop-Shop baut sein Angebot aus"

- "Zukunft Banking" by Netzwoche (03.12.2019)

"Intérets et avantages de la titrisation"

- Investir.ch (15.06.2020 / Web)

"New Strategic Cooperation Enables Access To Swiss And Liechtenstein Fund Solutions For ‘Gessler Capital’ Clientele"

- Press Release (02.02.2021)

"Financing projects through financial Instruments"

- corporateinvestmenttimes.com (16.08.2022 / Download)

Christophe Churet

Oyat Advisors

Gessler Capital successfully guided us towards the fund solution that was best for us in a professional and friendly manner.

Alan Barattolo

ARCAS Asset & Wealth Management

He has continually stood up for us and thinks outside the box. Thanks to him, we have reached an important milestone.

Jesús Arias

TIM Turicum Investment Management

Doing business with Vincent was straightforward. He understood me right from the start and gave me good advice.

TESTIMONIALS

CONTACT

OUR ADDRESS

Gessler Capital Ltd

Neugasse 56

8005 Zürich

Switzerland

Email:

UID: CHE-341.377.716